[ad_1]

Drugmaker AbbVie (NYSE: ABBV) is one of the largest healthcare stocks in the world, with a market cap of over $250 billion. It pays a reasonably high dividend yield and has products in a wide range of therapeutic areas, including eye care, neuroscience, immunology, and oncology. It also owns Botox through its $63 billion acquisition of Allergan in 2020.

But shares of the company have been falling in recent months — down 18% since hitting all-time highs last April. Is the healthcare company a good buy on this dip in price, or should investors be worried about it falling even further in value?

How well is the business doing today?

AbbVie last reported its earnings in July. For the period ending June 30, the company’s net revenue of $14.6 billion rose 4.5% year over year. Fast-growing immunology products Skyrizi and Rinvoq generated sales growth in excess of 55% and are key parts of the company’s future growth; management has previously forecast that combined, they will reach higher peak annual sales than top-selling drug Humira, which is losing patent protection next year. Humira remains key to AbbVie’s business for now, generating $5.4 billion this past quarter, nearly three times the $1.8 billion Skyrizi and Rinvoq generated.

The company also has its Botox business, which it acquired from Allergan a few years ago, that can drive more growth. Despite inflation, demand for that looks to be strong as Botox cosmetic sales of $695 million during the quarter rose 19% year over year. And with the economy returning to normal, those sales may rise even more.

This year, AbbVie is forecasting that its adjusted diluted per-share earnings will be between $13.78 and $13.98, which at the midpoint represents a 9.3% increase from the $12.7 adjusted earnings per share it reported in 2021.

Over the trailing 12 months, the company has generated a profit of $12.6 billion on sales of $57.3 billion. The business has also accumulated an impressive $22.2 billion in free cash flow during that time frame. That leaves plenty of room for it to pursue growth opportunities while still paying (and potentially increasing) its dividend, which AbbVie spent $9.7 billion on in the past year.

AbbVie’s dividend is likely to increase over the years

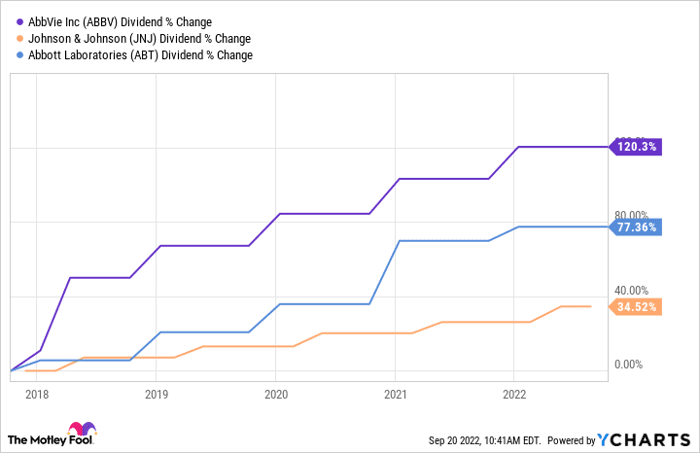

One of the most attractive features about AbbVie’s stock is that it offers investors a high dividend yield. At just under 4%, it pays more than double the S&P 500 (1.7%). If you wanted to collect $1,000 in dividends from AbbVie’s stock over the course of a year, you would need to invest roughly $25,000 into the business. But there’s even more incentive for you if you plan to buy and hold, because AbbVie is a Dividend King and it has more than doubled its payouts in just five years. That’s better than other dividend growth stocks, including pharma peers Johnson & Johnson and Abbott Laboratories:

Data by YCharts.

Is AbbVie stock cheap?

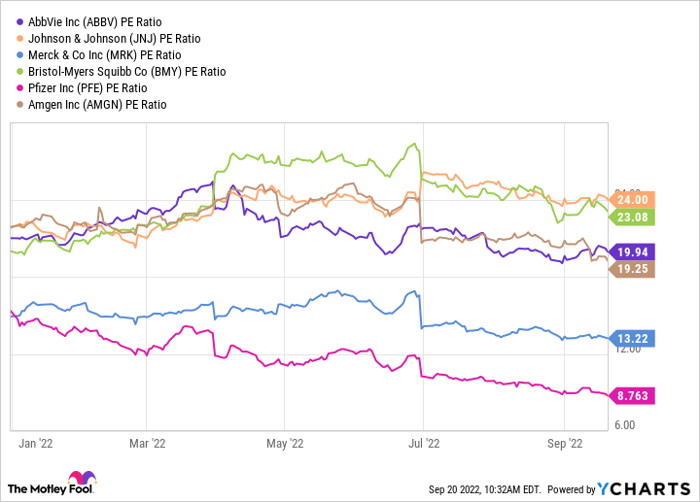

Despite the positive results, shares of AbbVie have been falling in recent months, but overall, the stock remains up around 4%. Although that’s modest, it’s better than the S&P 500, which is down a whopping 19% this year. As a result, AbbVie’s valuation hasn’t changed significantly, and it’s currently trading at 20 times its earnings.

Data by YCharts.

Compared to some of its peers in the healthcare industry, AbbVie doesn’t look like a cheap buy, but its valuation does appear to be fair.

Should you buy AbbVie’s stock today?

AbbVie is showing strength and versatility even at a time when other businesses are struggling. It’s a positive sign for investors and demonstrates why this is a safe stock to buy and hold for years. With a broad mix of products and a top dividend, this can be a suitable investment for investors who value both dividends and growth.

Although there is some risk that AbbVie’s sales could drop as Humira loses patent protection, its business is robust. With significant cash flow coming in, the company has the resources to pursue more growth opportunities. Overall, this is a solid stock that you can buy and forget about.

10 stocks we like better than AbbVie

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and AbbVie wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of August 17, 2022

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb and Merck & Co. The Motley Fool recommends Amgen and Johnson & Johnson. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link