The cost structure of injectable aesthetic treatments is changing.

Traditionally, the cost of an injectable procedure is based on the number of units used on a patient and is widely regarded as a reliable way to ensure a patient is paying for what they receive. Botox, for example, is usually $10-$15 per unit (Allergan, the Botox manufacturer, typically provides Botox in 200- and 100-unit vials, rather than in a milliliter syringe). A patient who receives 20 units of Botox could thus end up paying around $200-$300 for a treatment. But not all manufacturers charge the same for similar products, and the cost is not the same in all markets. Because of this, customers are often driven to find the best deal or lowest cost. Open up Groupon, and you will find any number of discounted services for Botox, Juvederm and Dysport.

But sizable shifts in the pricing models for services are starting to take place, thanks to distributors like Revance, aesthetic injectable clinics and medical spas.

Sisu, an Ireland-based clinic, is hoping to change the pricing-and-treatment model to emphasize treatment over cost while still being transparent. Sisu (named after a Finnish concept that loosely translates to resilience) raised $5.5 million in Series A funding in September from Greycroft and Bullpen Capital, in order to open 20 locations between 2021 and 2022 in New York City, Miami, Dallas and Houston. Instead of focusing on a per-unit price or number of units, Sisu offers fixed costs based on the number of areas of the face that are treated. Sisu offers anti-wrinkle treatments ranging from approximately $200 for one area of treatment to $410 for four areas at its eight clinics in Ireland. Its U.S. prices have not been determined yet. Typically with per-unit costs, the total cost for a treatment or procedure is only known after a consultation with a doctor, which makes pricing transparency harder to achieve upfront. But Sisu displays its cost on the clinic’s website — however, the recommended number of treatment areas for the desired outcome still requires a consultation.

By changing the pricing model for these procedures, Sisu is hoping to reintroduce symmetry into aesthetic injectable prices. Patients and providers who prioritize price over outcome are ultimately held back from receiving and offering the desired treatment.

“When you focus on results, it becomes the key component of the treatment as opposed to the specific pricing,” said Dr. Brian Cotter, Sisu co-founder. “That’s one of the things in the U.S. that’s quite confusing for people, especially when it’s their first time getting a treatment, because they don’t even know what 10 units of Botox means.”

Revance, the distributor behind four new “clean injectables” called the RHA Collection, is also trying to disentangle the idea of injectables as a commodity and put the focus back on treatments. But its approach differs from Sisu’s by not allowing physicians to advertise the price of RHA Collection treatments prior to the consultation.

Dustin Sjuts, Revance chief commercial officer, said that approximately 35,000 providers have been trained in injectable procedures, but patients cannot clearly discern who is a good or bad provider, and instead choose based on the least expensive cost. With its approach, patients choose physicians first rather than a less expensive treatment first.

“The challenge is that [no one] knows what or how much you need to use until you go to a qualified physician,” he said. “It’s not actually about transparency, but [it’s about] trying to drive the consumer to not make a transactional decision.”

Sisu’s model challenges the idea that quality treatment and an advertised cost are antithetical to one another, since it does not focus on per-unit costs. But because of these competing methods of rectifying the same issue with injectable pricing, even if Revance’s and Sisu’s goals to focus on treatments versus per-unit costs plays out, they still invariably confuse the lay customer’s understanding of the market.

“As a practitioner, I love that I could [focus on treatment] because customization is so important. There is no one-size-fits-all,” said Vanessa Coppola, owner of Bare Aesthetic. “What I find that is difficult and a roadblock [about RHA] is the lack of transparency about the pricing for patients.”

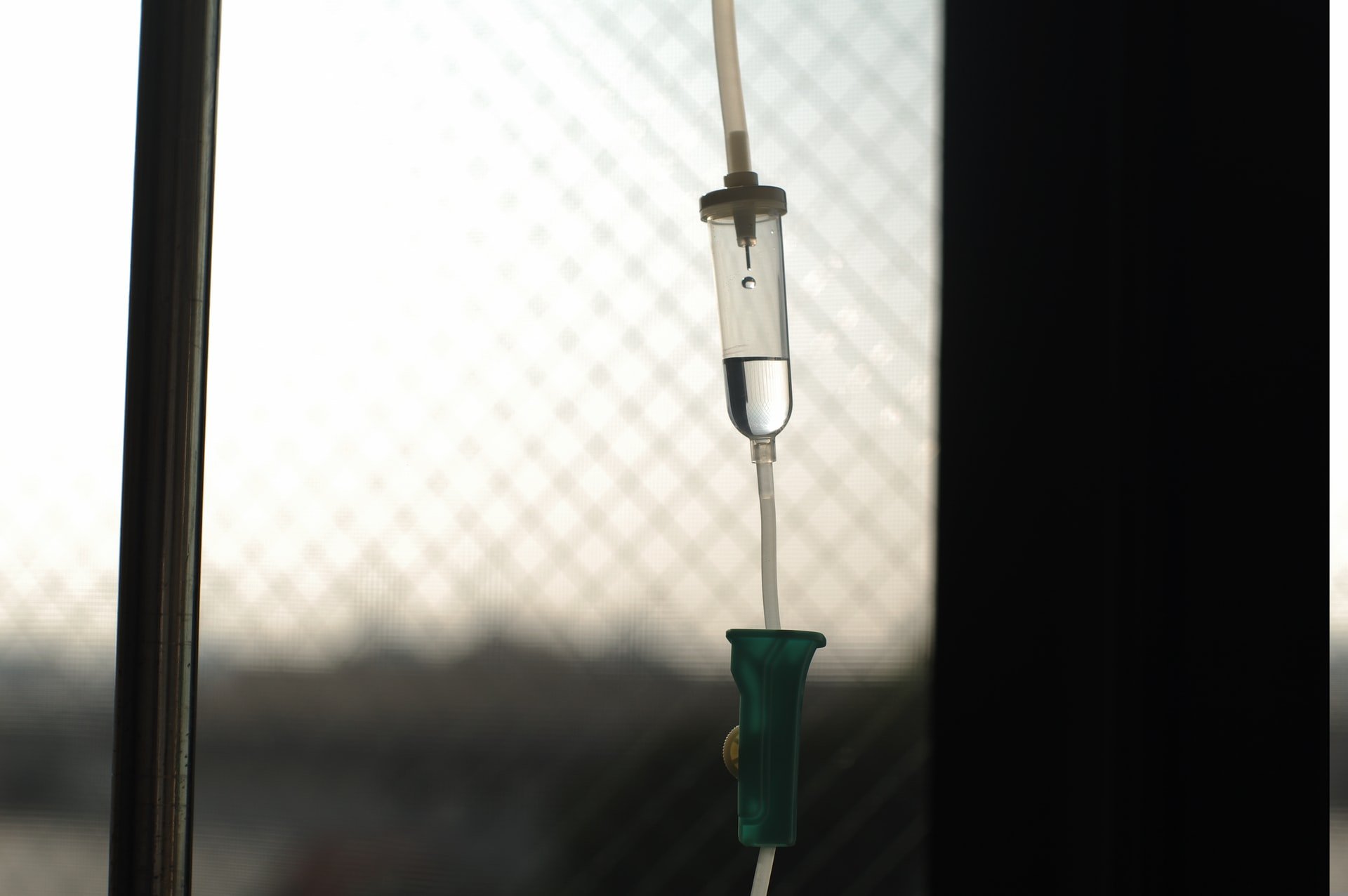

Coppola explained that the cost for an overall treatment using a product like the RHA Collection could be influenced by the size of syringes, which are often dictated by manufacturers. Not all patients require a full syringe to achieve the desired outcome, and the provider can choose to either pass that full cost of a syringe onto their patient or only charge for what was used. RHA II, III and IV come in 1 mL syringes, while RHA I is still in clinical trials and not available on the market. Revance declined to share the per-unit price for its products with Glossy.

“A less-is-more approach is more important than using up all the filler just because I bought a 1 mL syringe and I feel I have to use the entire thing,” she said. “But people still want to know and should know the base cost [for a product or procedure]. Cost is always a factor with everyone, and everyone’s perception of [expensive] is different.”